-

40% of employees now worried about their future financial state

-

Employees struggling with finances far less productive

-

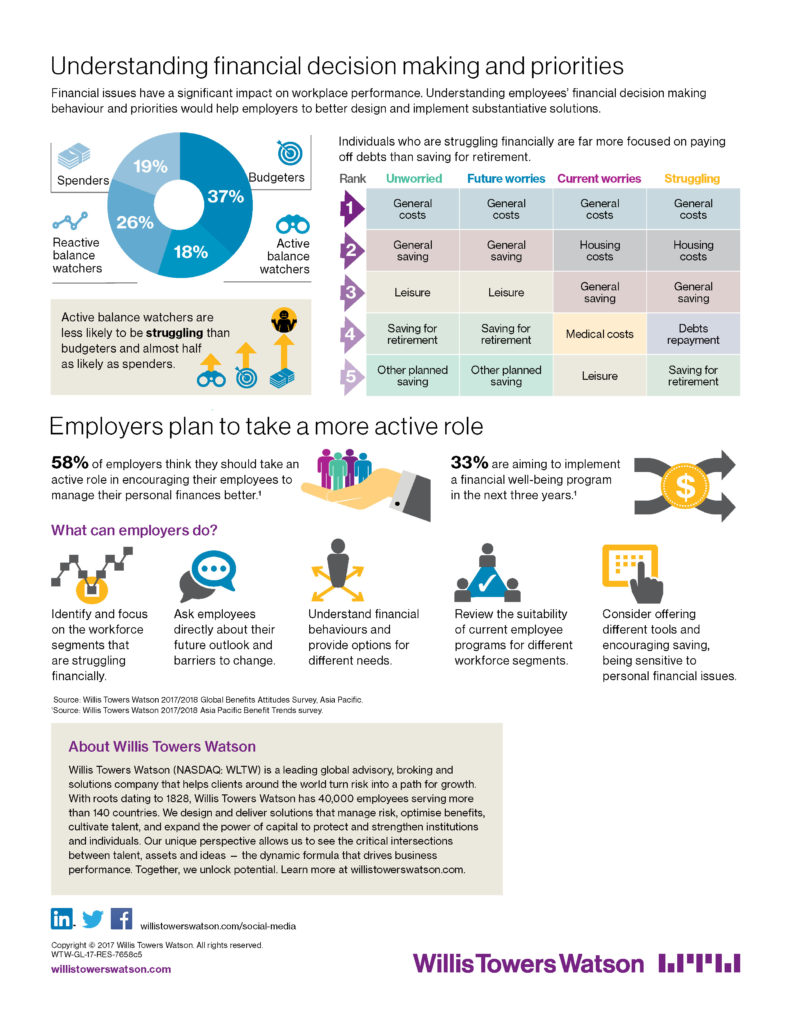

Differentiated approach that targets employees’ financial goals most effective at addressing concerns

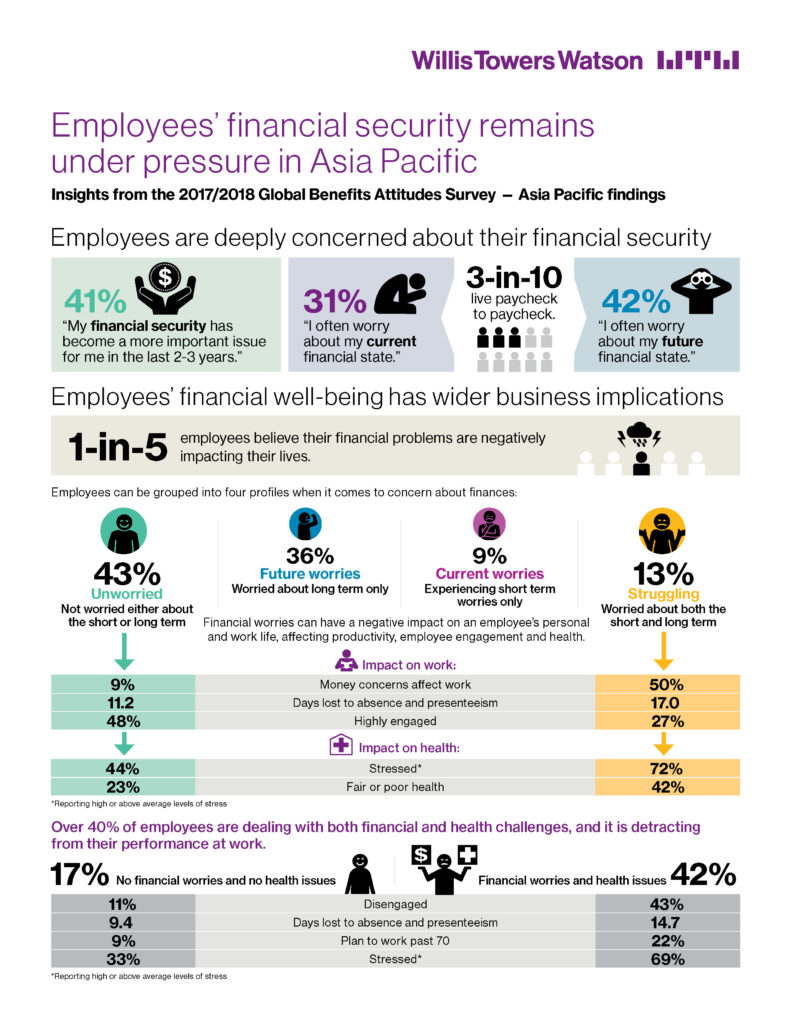

Employees in Asia Pacific are deeply concerned about their financial security, negatively impacting their personal and work lives, according to a new survey by Willis Towers Watson and this is something that HR needs be worried about too.

The Willis Towers Watson 2017/2018 Global Benefits Attitudes Survey found that a fifth of all employees in Asia Pacific now believe their financial concerns are negatively impacting their lives. In addition, more than two in five worry about their future financial state, while a similar percentage said their financial security has become a more important issue for them in the last two to three years.

The survey findings demonstrate clearly how financial pressures correlate with stress, poorer health and lower engagement at work, all of which impact productivity and create higher levels of staff turnover. By extension, this affects the overall performance of the company.

Jeff Howatt, Head of Retirement, Asia, Willis Towers Watson explained, “The ongoing financial worries that are troubling so many employees are taking a toll on their financial confidence. The negative impacts are not only on the personal lives of employees—both physically and mentally—but also on their behaviour at work, particularly their productivity and engagement.”

This is especially true among the 13% of “struggling” employees, identified in the research as those worried about both their short- and long-term finances. Half of these struggling employees said money concerns were keeping them from doing their best at work. Higher levels of absenteeism were found among this group.

Additionally, almost three in four struggling employees reported above average or high stress levels, while 42% described their health as poor. Only around a quarter of these employees were fully engaged at work. This shows a clear connection between financial worries and good health.

While employers understand the impact, the challenge is how to provide the right sort of support—neither too superficial nor intrusive. Given that almost half of employees would like their employers to offer tools that provide suggestions on how they can improve their financial situation, finding the right solutions can be highly beneficial for all parties.

Howatt advised, “As a starting point, employers should identify and focus on the workforce segments struggling financially. Then they should communicate with their employees to try to understand their future outlook and barriers. In this process, it is important for employers to note how financial vulnerabilities differ across the workforce—a young Millennial still trying to pay off student debt has very different needs compared with a Baby Boomer who is trying to save for retirement. It would also be helpful for employers to review the suitability of their HR and retirement arrangements for different workforce segments to lessen the long-term financial burdens of the employees.”