With over 70% of companies anticipating strong economic growth this year, why do 77% of HR hiring heads say they won’t take on new staff?

HR Magazine caught up

Business booming

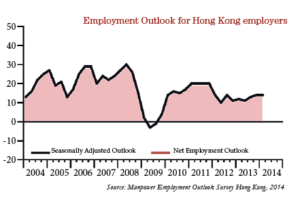

Despite continued instability within the global economy, on the whole, organisations in Hong Kong appear to be optimistic about their business outlook in the year ahead. Mercer claims that 44% of companies expect their 2014 business performance to be better than that of 2013. This is echoed in the results of a recent survey conducted by Hays , which indicates the vast majority of employers surveyed, 71%, expect business activity to increase as we progress through the year. With such high hopes and positive signs of growing confidence among local organisations, does this mean HR will boost recruitment and plan a rise in salaries?

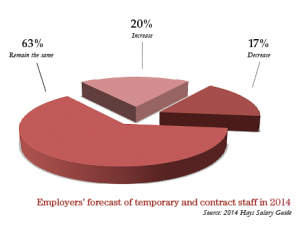

Despite the anticipated strong economic growth, there appears to be significant inactivity within HR. According to Manpower’s Employment Outlook Survey, only 20% of the 800 plus employers surveyed forecast an increase in staffing levels in Q1 2014, while 77% expect no changes in the same period. Similar predictions can be found in the 2014 Hays Salary Guide, where only 20% of companies plan to increase their temporary and contract staff in 2014 and 63% expect to maintain the existing headcount. The Finance Sector, with one of the most conservative economic outlooks, sees nearly 80% of financial executives looking to maintain the same headcount in 2014 .

Reasons to be reluctant

So why this cautious behaviour when it comes to seeking new talent and why such hesitancy to expand human resources? One suggestion, according to the American Express Hong Kong Business Momentum Survey recently carried out by Nielsen, is that labour costs are a major concern for 2014. In fact, a staggering 79% of CFOs surveyed cited it as the key challenge for the coming year, followed by China’s economic growth, 74%, and currency fluctuation, 73%. Property costs are at the bottom of the list of CFO concerns, with only 32% acknowledging this as a challenge. Interestingly, just 15% of respondents who intend to add staff will do so with a focus on sales and marketing—as opposed to support function roles—suggesting a priority to boost existing business.

Salaries stay stable

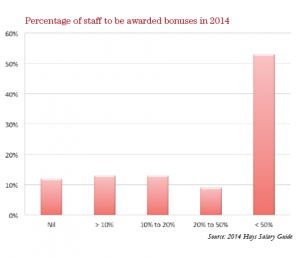

It seems that awards and bonuses, rather than salary rises, are currently the way forward for a cautious HR when it comes to retaining staff. Despite a rise in hiring activity, salary increases for 2014 are set to remain similar to last year for employees in Hong Kong. According to Hays, just over half of employers, 54%, intend to raise salary by 3 – 6% with just under a third expecting an increase of less than 3% or no pay increase at all.

HK losing edge, but HiPos still rewarded

Despite salary rises remaining stable in Hong Kong, Quane warned this could lead to economic stagnation in the coming months and run the risk of the city losing its competitiveness as an international financial hub and magnet for global talent. On the other hand, for high calibre candidates and those already in highly skilled positions, this stability in salary increase does not necessarily hinder career progression.

Marc Burrage, Regional Director, Hays, Hong Kong explained, “Cost control has lowered the ceiling for salary increases in many organisations across Asia as employers are more focused on the bottom line. Certainly salaries remain competitive, and for the top talent many employers offer higher packages to entice candidates, proving that money still talks. But in general, salaries are starting to become more conservative than they once were. This means that those candidates with in-demand skills and realistic salary expectations can be confident that this year will provide them with the opportunity to secure a challenging career move and a salary increase.”

Kerry Rooks, Chief Human Resources Officer, The Prudential Assurance Co. Ltd also maintains that a tighter control on costs in the coming months could mean good news for highly skilled candidates within the job market. She believes they could expect to see employers raising the bar when it comes to offering greater rewards and benefits in their attempt to secure top talent. She explained, “You have to pay the best to attract the best so when it comes to finding good people, HR will spend. Exceptional talent will be expensive but in this tough market environment, companies are willing to spend top dollar to find the right people despite tight cost control. It is important that HR strategies incorporate transparency and understanding of individual rewards to help employees understand the true value of their package. When it comes to retention, HR needs to adopt customised solutions to meet the needs of individuals as one size does not fit all.”

Such compensation and hiring trends are already evident across several key industries in Hong Kong. When Bó Lè Associates recently surveyed over 980 top-level decision makers in its Annual Regional Client Survey for 2013/14, it found that most companies plan to offer one to three months’ salary in bonuses while increasing their senior executives’ base salary by 5 – 10%.

Peter Yu, Director of Randstad Hong Kong explained, “Employee sentiment is that they want to be rewarded for all their efforts in the past year through a pay rise and bonus. For business leaders and HR departments already caught in a talent crunch and offering a myriad of financial incentives as a short-term solution, the next three months will be both challenging and critical. Companies that suffer less will be those that have robust, long-term human capital retention plans already in place.” With this in mind, all signs point to the idea that talent retention, by way of awards and bonuses, will be the biggest priority—and perhaps challenge—for HR in the year ahead.

APAC at a glance

Looking further afield, in contrast to Hong Kong, salaries across APAC are predicted to rise by an average of 7% in 2014, with Vietnam and India experiencing the largest salary increases of 11.5% and 11%, respectively—due in part to steady rises in inflation. Currently, Singapore is set to jump 4.5%, while Japan will see the lowest increase at just 2.3%.

These findings, taken from the APAC Salary Budget Planning Report released by Towers Watson, support the comparative growth of Asia’s emerging economies. Southeast Asian nations currently have the highest economic growth rates at around 6 – 8.5%, but also have equally high inflation rates. With inflation as high as 7% in some economies, companies must reflect this adjustment when calculating their salary increases. For other APAC countries, the steady rise in salary rates shows the growing concern for the sourcing and retention of skilled talent. Sambhav Rakyan, Global Data Services Practice Leader—Asia Pacific at Towers Watson summarised, “People may say it’s not about the money, but the reality is that base pay is the number one driver for attraction and retention globally.”

China leads the way

China, on the other hand, is poised for Asia’s strongest salary growth in the year ahead despite the country’s economic growth showing signs of slowing down with state government setting its 2013 target GDP growth rate to around 7%—the lowest in 20 years. This, according to Aon Hewitt’s Human Capital Intelligence Report for 2013, which covers over 4,000 mainland China companies across forty major industries . This has been accompanied by a slowdown in the growth of average salary and turnover rates in 2013 with increases of 8.5% average salary growth and 14.3% annual turnover recorded. The level of mainland salary increments are also supported by research from Hays, which indicates over half of employers in mainland China, 58%, intend to increase salaries between 6 – 10% this year. This may be due to the fact that domestic companies in China are putting great efforts into enhancing their salary competitiveness and focusing on the Chinese market while the global headquarters of foreign firms became more stringent in their efforts to control salaries.

Peter Zhang, Vice-President and Partner, Head of Compensation Practice for Aon Hewitt in China added, “Although the 2013 average salary growth in China is lower than last year, it is still the highest within the Asia-Pacific region. Pressures resulting from the expansion of human capital costs forced companies to make the most out of limited funds to create a high-performance corporate culture and pay-for-performance practices. Companies characterised as high-performance cultures tend to reward their outstanding employees with incentives that are more closely linked to their performance…We believe that pay structures more closely linked to performance and a greater focus on compensation will be more widely adopted by all industries.”

Relatively smooth road, but watch out of HR potholes

Whilst organisations in Hong Kong remain cautious in the early part of 2014, it is evident that their confidence in the future of the economy and its potential for growth is promisingly high. The important thing now, however, is that such cautious measures do not lead the city to become stagnant. In doing so it may risk losing its competitive edge as an international financial hub as well as its appeal to talent from across the globe. For now, at least, it seems that the road ahead runs relatively smooth for HR in 2014—but failure to establish and manage robust, long-term human capital retention plans could bring dire consequences.

Sources

[1] 2014 Hong Kong Human Resources Planning Snapshot Survey by Mercer

[2] 2014 Hays Salary Guide

[3] American Express Hong Kong Business Momentum Survey 2013

[4] Randstad Workmonitor, Hong Kong Employees’ Outlook 2014

[5] Aon Hewitt’s Human Capital Intelligence Report for 2013